If there’s anything we’ve learnt from Covid, it is that the world is one messy interconnected web. Trouble at point A soon spreads to point B. These days, a butterfly beating its wings in Brazil not only causes a tornado in Texas, but the ensuing drop in exported fuel to India could cause a rupture in the fashion supply chain and suddenly your favorite pair of jeans is out of stock. We might sit back and watch as catastrophe befalls another country, silently relieved it isn’t happening to us, but weeks or months later, we will feel the burn from the shockwaves in the aftermath.

Inflation goes global

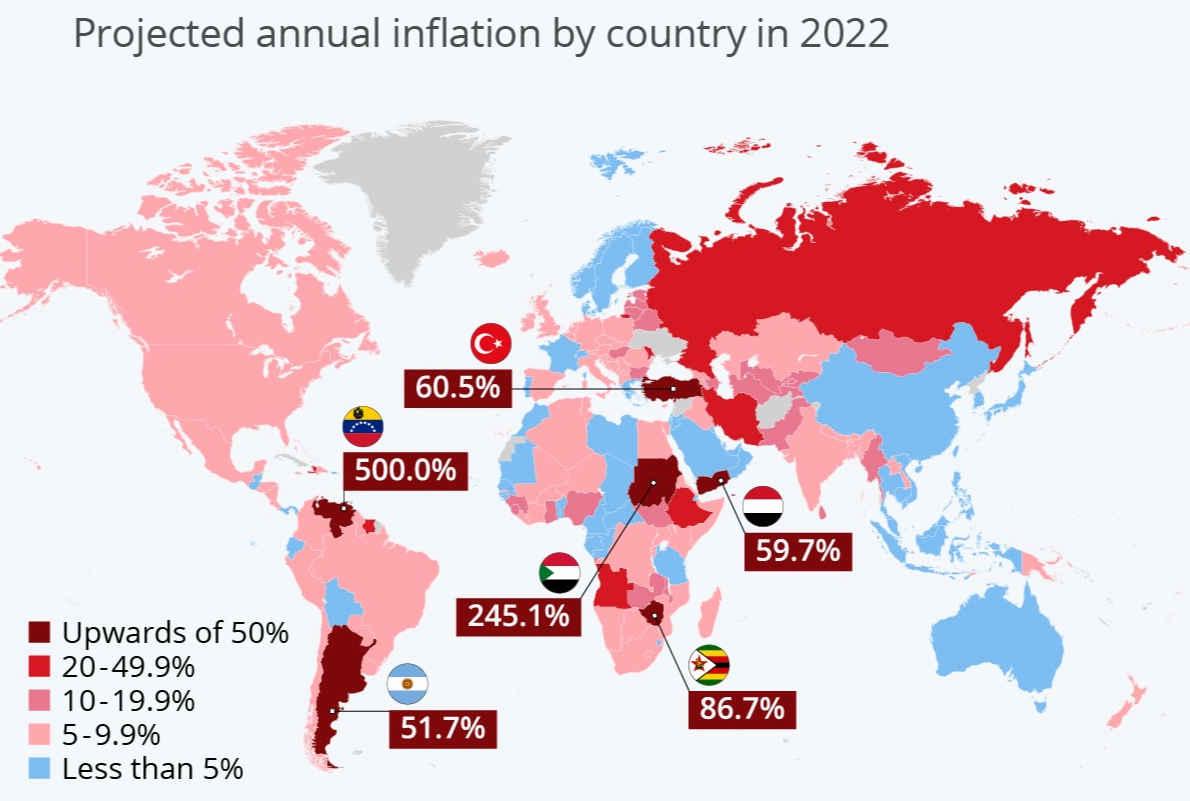

The current rise in inflation is going global. Back in February, the Guardian wrote about the cost of living rising from Pakistan to the US and from Australia to Germany. Reuters, in April, put it down to rising post-pandemic demand coupled with unrecovered supply chains. Things may have improved but Russia’s war in Ukraine caused energy prices to go up and when energy prices go up – the price of everything goes up. With Ukrainian grain fields burning, food prices soared too. Simultaneously, China responded to a resurgence of Covid with further supply chain battering restrictions. Since most supply-chains touche China at some point, the prices went up even further.

To make matters worse, the US and the UK had printed wads of cash to pay for pandemic related spending, which some argue had an effect, albeit delayed, on inflation. The perfect inflationary storm.

Source: https://inflationdata.com/articles/2022/05/21/worldwide-inflation-by-country-2022/

Inflation hits the closet

The fashion industry is most certainly not sheltered from the storm. Energy-intensive, with a complicated supply chain that touches as many countries as there are memes on Liz Truss’ departure from No. 10, the fashion industry is facing rising costs at an alarming rate. Consumers are having to choose between a sparkly new dress for New Year’s Eve or keeping their homes warm in winter, resulting in a drop in sales across higher margin product categories. Historically, apparel and footwear price rises have lagged the consumer price index (CPI) by a large amount. But this year Fashion prices have seen more of an increase, although still less than the CPI.

Some retailers are passing on the costs to consumers. While others are absorbing the loss in profit, fearful of losing a volatile and untrusting consumer base. And many others are passing the burden to manufacturers, by negotiating lower prices. Manufacturers, having nobody to pass the burden to, except to their struggling labor force, are pushing back on those negotiations.

How fashion retailers and manufacturers can shelter from the inflation storm

The fact remains that retailers need to increase revenue to survive global inflation. It can be done by either increasing prices, reducing promotions, or both. Instead of using a blanket approach across the entire product range, however, a granular pricing strategy can ensure the perfect balance between lower prices for preservation of market share and higher prices for ensuring profitability.

Aside from obvious differentiators like Cashmere silk, consumers do not always pay particular attention to raw material costs when coughing out on ticket price. As such, brands can also get creative, switching to raw materials that have suffered lower inflation than others. Using designs and manufacturing technologies that utilize less energy can also cut costs without hurting the flow up or downstream.

Traditionally demand forecasting in retail was based on historical data. But as explained in a paper in the European Journal of Operational Research, more immediate methods of assortment and price optimization are now needed. It is notoriously hard to predict demand for fashion products, due to new or customized styles and shorter product lifecycles. With inflation, liquid assets might be more valuable, but an overstocked warehouse could be devastating.

This means that optimizing the assortment and its pricing needs to happen in market, at a very fast pace. The paper suggests that early price reductions can lead to accelerated demand learning. Not only is data critical but retailers need to respond quickly to what it is saying. An adaptive approach that keeps a constant flow of goods, continuously balancing demand and supply, is crucial.

The trifecta of planning, visibility and agility, coupled with technology as an enabler, will be the key to success as businesses try to weather the inflation storm. Companies need to remain calm and strategic, optimizing everything from their forecasts to their manufacturing, from their workforce to their processes. Companies that batten down the hatches whilst the storm rages, may well find a booming period of innovation and renewal awaits them once the storm has passed.

Arming against inflation and supply chain disruptions with technology

Thankfully, there are tools at our disposal that make such quick strategic pricing, planning, and optimizing much more doable than a decade ago, such as product lifecycle management tools like Infor PLM for Fashion as well as industry-focused ERP solutions like Infor CloudSuite Fashion. The best thing about such tech is that it is quick, and has the ability to process vast quantities of data in the fraction of the time it would take a human brain.

Business Intelligence systems can provide a single-source-of-truth in data across the enterprise, together with customizable reports that can be modified on the fly based on changing requirements.

The latest academic algorithms for forecast optimization are often too complicated for handmade spreadsheets. However, many of the best digital systems incorporate such algorithms, ensuring results with a mathematical sophistication otherwise unachievable.

AI can analyze data, both internal and Big data, to determine trends, and suggest optimization strategies for assortments and pricing.

Repetitive and redundant tasks can be automated so employees can focus on being creative and innovative instead of being bogged down in tedium, resulting in faster decision making and better business strategies.

Requirement planning systems can reduce wasted resources. Their implementation usually results in the streamlining of complicated processes through traceability, which has as many benefits as the tech itself.

Charting the course for global supply chain resilience

Weathering the storm would also be more likely if brands and manufacturers formed close partnerships, sharing their data as well as anticipating and planning for future trends, a strategy that proved invaluable during pandemical troubles. All parties along the entire length of the chain should become BFFs instead of squabbling over who gets the most pennies.

Finally, let us not forget sustainability. It is important and will continue to be important. In fact, had we been more sustainable, we wouldn’t be having the inflation problems we are having today. Cost cutting by making things less sustainable will only lead to ruin.

The only constant in today’s world is volatility. World leaders use the globe as their personal roulette table, betting our futures for their personal pride or gain. The only way to survive is to strategize as best you can for the now but change strategy quickly when you find you got it wrong or that the needs of now suddenly changed.

The last five months have seen two monarchs, three PMs and four chancellors. In such an unpredictable environment, the right technology will be an invaluable crystal ball for manufacturers and retailers looking to hedge their bets against rising rates.

Written by:

Monalee Wonnacott

Senior Consultant, Fortude

Related Blogs

Subscribe to our blog to know all the things we do