Omnichannel has been a buzzword across fashion retail for so long that the industry should have moved on to the next big idea by now. Increased digitization due the pandemic, coupled with other challenges of the post-covid retail climate, has resulted in the term omnichannel appearingi consistently in retail studies and white papers.

The definition of omnichannel is often disputed. Generally, across the industry, omnichannel has come to mean interconnectedness and fluidity between all channels. This makes it very different from multi-channel, where many channels exist, but as disconnected silos. In omnichannel, all channels are perfectly inter-connected, and a shopper can seamlessly switch from one to another; e.g. a wish-list can be created on an app and retrieved at a physical store in order to try clothes on. In a multi-channel setting, a shopper can choose one channel or another, but if switching from one to another, the shopping journey requires a restart from scratch; e.g. a wish-list can be created on an app, but once in the physical store, the shopper would have to hunt for each item to try it on, sometimes finding a lack of availability or a difference in price.

True omnichannel must synchronize all existing channels of supplies and demand and make them work cohesively for a singular journey. From the brand’s point of view, maximum use of inventory for maximum return on investment. From the consumer’s point of view, maximum convenience and maximum flexibility.

Customers today do not limit a shopping journey to one channel. A consumer may research online, or on their mobile phone and visit a store to make their final purchase. Or do the same journey in reverse order. Fortude’s Robert McKee has a story of when his wife wanted a specific cookbook. He went to a bookstore (a local branch of a national chain), found the book but it was terribly heavy. Disinclined to carry it around all day, he photographed the QR code with his mobile phone, searched online and found it was available cheaper online with free next day delivery. An opportunity missed for the local branch, but a very common occurrence today.

Technological advancements continuously increase the number of sales channels available to a consumer. At first digital meant having a website. Then it meant making the website mobile friendly. Next it meant also having an app. Now it includes mini programs hosted on established apps and online games. New channels and cross-channel journeys make true omnichannel extremely difficult for a retailer.

To a shopper there are often many pitfalls in the omnichannel journey. The key pain points are variances in offered catalogs, prices and stock availability across channels. There is also frustration with having to restart journeys or redo steps. Some disappointment arises from nuances, for example, when a product looks different online to how it looks in a store or the shopping experience is objectively easier in one channel when compared to another. For a brand, such issues result in lost sales or returns.

In 2019, data from Ayden, a global payment firm, showed that the omnichannel shopper is retail’s best friend as globally they spend 30% more per purchase than single channel shoppers. A special report around the same time showed that 87% of shoppers would like a personalized consistent shopping experience across channels whilst only 53% of retailers made it a top priority, i.e. consumers were racing ahead with the concept of omnichannel whilst brands were struggling to keep up.

In 2020, the game-changing covid19 pandemic marked a watershed for humanity. Retail was hit hard. Stores had to close, shoppers were given stay at home orders and everybody started working in their pajamas. Unless it was in a contactless, hermitically sealed isolation pod, consumers were not keen to go shopping for clothes. Sales shifted towards digital but decreased across all channels. Retailers had to innovate. Studies found that adding essentials, such as hand sanitizer, to its portfolio helped increase sales of a brand’s core offering. Intimissimi, an Italian innerwear brand, integrated online and offline inventory to provide a smooth omnichannel experience. In China, Taobao Live increased retailer participation by 719% by making it easier for offline retailers to join its online livestreaming platform. But retailers such as Monsoon, Oasis and Top Shop had worse luck and went into administration. Back in April it was predicted that a large number of global fashion companies will go bankrupt by the end of 2021.

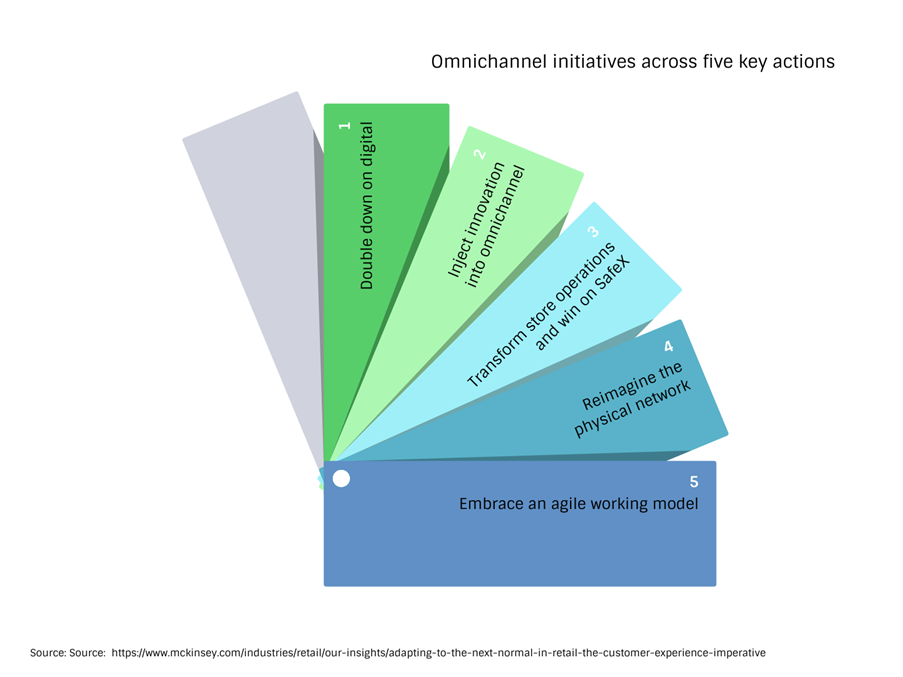

A recent McKinsey report estimates that the US is most likely to achieve herd immunity in Q3 or Q4 of 2021ii . Everybody is talking about what the new normal will be after then. McKinsey surveys show that during the pandemic offline shoppers shifted to online or to other no-contact channels such as “buy online, pick up in-store”. Many say they will continue with these new shopping behaviors even after the pandemic. The State of Fashion 2020: Coronavirus update stresses that once the immediate effects of the crisis subside, the world will see digital acceleration, corporate innovation and M&A and insolvencies across fashion retail. Another special report, Adapting to the next normal in retail: The customer experience imperative has identified the following five key actions, illustrated in the figure below, that omnichannel leaders have taken initiative on in order to adapt to the next normal customer.

How can one achieve this seemingly unattainable, elusive concept of true omnichannel? Even before the pandemic, the cost of such initiatives was high, and it seemed possible only for extremely successful luxury brands. Post-pandemic, what can a brand do if all the gurus are saying omnichannel is needed to survive, but it is both seemingly unattainable and unaffordable?

In a Forbes article in 2019, Steve Dennis shook things up by suggesting that omnichannel was dead and that “harmonized retail” was the future. Harmonized retail is about “showing up for the right customers, where it really matters, in remarkable ways”. Instead of striving (and failing) to achieve the impossible task of making all channels be seamlessly interconnected, focus instead on connecting the most important channels at the most important touch points, in ways that really deliver customer satisfaction.

Harmonized retail is more achievable than true omnichannel but provides most of the same benefits. It is more achievable simply because it blends only a subset of channels and a subset of the touchpoints between them. Knowing exactly where and how to focus efforts and budget makes harmonized retail attainable and affordable. It might not be possible to reap all the benefits of a perfectly fluid and interconnected web of channels, but harmonized retail will allow a seller to deliver a pleasurable customer journey across channels, to most customers, most of the time. It is making a retail strategy out of John Lydgate’s famous quote, “You can please some of the people all of the time, you can please all of the people some of the time, but you can’t please all of the people all of the time”.

The first step in harmonizing retail is to choose the correct channels and the important cross-channel touch points to focus on. Once these have been identified, it is essential to choose the correct software systems and to blend digital and physical in a remarkable way. Some changes will also need to be made to cater to the post-pandemic next normal customer. Finally, a brand needs to make the most of analytics to continuously monitor and adapt harmonized retailing strategies.

In my next blog post, I will delve deeper into each of the above points.

The evolution of retail

Could harmonized retail mean the survival of a retailer, post-pandemic? Perhaps, but it will probably take more to come out on top after a year of Covid19.

In truth, the pandemic will cause a Darwinian shakeout. Evolution is not a linear process, it has periods of rapid change, triggered by drastic environmental stimuli. But evolution does not march towards betterment; it is indifferent to ethics. Traits that increase the chance of survival proliferate, those that do not, disappear into the ether. So here is where the analogy falls short. Consumers are not indifferent to ethics, the pandemic has struck a chord deep within the public, especially millennials and generation Z. One that was developing for decades, but that Covid19 has made stronger and louder. A chord that is in harmony with the planet and its people; a chord that is dissonant with over-consumption, exploitative capitalism and waste. People are calling out for change all around us – sustainability, Black Lives Matter, #MeToo. There is a strong drive towards doing the right thing, not for personal gain but for global betterment.

Retail will see a rapid evolution and those that emerge on top will not merely use instruments for survival. They will self-disrupt, redefine themselves and add an authentic flavor of themselves into their channels, outside of pure marketing. They will evolve their brand ethos to resonate with the chord that has been struck within their consumer base. Brands that survive will be those that have an ethos they themselves believe in. Authenticity is key. Harmonized retail can bring together key aspects of diverse channels together, so they work together beautifully, like a coordinated symphony. But the composition of the music is up to the brand. Strike the wrong chord, and therein lies the demise; the crowds will cover their ears and walk away.

i. In retail, the term omnichannel can be coupled with a range of functions – sales, customer service, inventory and marketing, to name a few. In this article, I will be focusing on omnichannel sales.

ii. Data on other countries is being compiled at time of writing

Written by:

Monalee Wonnacott

Senior Consultant - Infor Services, Fortude

Related Blogs

Subscribe to our blog to know all the things we do