The COVID-19 pandemic has thrown global business into turmoil. Known as the biggest since the Spanish Flu in 1920, this pandemic is testing the resilience and agility of the business mindsets, approaches, processes, and tools that we’ve grown used to over the past 100 years. The retail industry is one of the industries hardest hit by the pandemic, and within the retail industry, the fashion and luxury (F&L) vertical has been hit even harder.

Fashion and luxury (F&L) retail apocalypse: The pandemic severely impacts the industry

Due to the travel restrictions and decline in consumer spending caused by job losses and pay cuts, many fashion and luxury retail companies saw a marked decrease in their revenue.

Major fashion retailers in the UK and Europe such as Arcadia, Debenhams, DW Sports, Monsoon, Cath Kidston, Laura Ashley, Brooks Brothers, and M&Co were forced into administration, putting thousands of jobs at risk

Zara expects to close as many as 1200 department stores around the world. US retailer Gap hopes to move to a franchise-only retail model in Europe, closing all of its own stores in the UK.

Meanwhile, the fashion e-tailers ASOS and Boohoo are thriving in the pandemic, thanks to their superior e-commerce platforms. Between 2019 and 2020, ASOS quadrupled its profits, and Boohoo reported a 51% profit increase in the first half. Founded in 2000 and 2006 respectively, ASOS and Boohoo are capitalizing on the collapse of brick-and-mortar retail through acquisitions—the 243-year-old retail chain Debenhams has been acquired by Boohoo, whereas Arcadia’s Topshop, Topman, Miss Selfridge, and HIIT brands have been sold to ASOS. After the acquisition, Debenhams and Arcadia stores will be closed permanently.

“…the companies best able to react to these (pandemic related) shifts in fulfillment challenges will be those companies with multiple distribution touchpoints.“

B2B DIGITAL COMMERCE 360 REPORT

Dropshipping via marketplaces

Compared to USA counterparts, the vast majority of UK fashion retails are lagging behind when it comes to omnichannel retail and online marketplace integrations. Many brands rely on old-fashioned, rigid, long-term planning and do not make use of data and analytics that would allow them to be more agile in their strategy.

To keep up with the fashion industry’s fluidity, constantly-changing consumer behavior, and to stay afloat during crises like the ongoing pandemic, fashion brands must embrace innovative sales and distribution strategies.

An online marketplace is an e-commerce website or a mobile app that facilitates brands and customers to sell and buy products.

Once an e-commerce marketplace sells a product, it passes the customer order to a third-party supplier, who ships it directly to the consumer. The consumer is generally oblivious to this process, which happens in the background of the marketplace.

For example, the Germany-based upmarket marketplace Breuninger sells fashion and luxury products of more than 1000 brands, including Boss, Gucci, Burberry, Polo, and Karl Lagerfeld, through their online marketplace. When Breuninger sells a Burberry handbag, the product is shipped to the end consumer in Burberry packaging.

Figure 1: Dropshipping at a glance

Whether your company is going through a crisis or not, dropshipping and integrations can present many opportunities and increase the profitability of your fashion business.

A resilient distribution network

Global brands can use marketplace dropshipping to switch the distribution to an alternative location (e.g., 3PL distribution center, ship from store, dropshipping from an alternative territory) in times of disruption or stock unavailability. ‘Ship from store’ further enables omnichannel fulfillment. Due to travel restrictions, retailers in the US are converting their department stores to distribution and fulfillment centers.

For example, with travel restrictions and the temporary closure of distribution centers in the US, a luxury retailer in the UK can ensure business continuity by shipping global online orders from an alternative distribution center in Canada.

Dropshipping and marketplaces enable brands to be truly global, agile, and able to adapt to disruptions.

66% of retailers report that the use of dropshipping also increases revenue to the tune of 14% or more.

– Supply Chain Collaboration in Transformative Vertical Industries: Implications of Omnichannel and Dropshipping

Onboard existing marketplaces

There are many advantages to onboarding a marketplace. On marketplaces, brands can sell 24×7 and leverage the reputation and the global reach of the marketplace. For example, ASOS, one of the largest fashion marketplaces globally, ships to 239 countries from multiple fulfillment centers in the UK, the US, and Germany.

Integrating retail into a marketplace also means that the brand does not have to maintain its own website as an online store.

Leveraging big data and analytics

Online marketplaces capture heaps of data from various customer touchpoints. Brands can leverage data to better understand consumer behavior and make short- and long-term plans. Many brands rely on data for quick decision making, which is essential for staying agile in disruptive times such as the COVID-19 pandemic we are experiencing now.

Marketplaces also analyze consumer behavior data for targeted and personalized marketing on social media platforms such as Facebook and Instagram. The marketplace plays a crucial role in attracting younger consumers and retaining their loyalty.

New trends

Augmented reality and 3D visualizations

With the rapid evolution of new technologies such as 3D visualization and virtual and augmented reality, fashion and luxury retailers can deliver an engaging online shopping experience for customers.

A female shopper can visit the ASOS online marketplace and define their height, weight, tummy shape, hip shape, bra size (all sizing systems), fit preference, and request a virtual ‘Fit Assistant’ to help find the right size quickly. This has helped ASOS to cut down the returns significantly. British-Portuguese online luxury fashion marketplace uses a similar tool called “Fit Predictor,” which calculates the best size based on previous purchases.

Integrating dropshipping with your ERP

F&L brands looking to implementing a dropshipping solution should select an ERP implementation or a system integration partner that has the infrastructure, proven methodology, capacity, domain expertise, and an understanding of complex dropshipping scenarios to ensure the ROI of the solution.

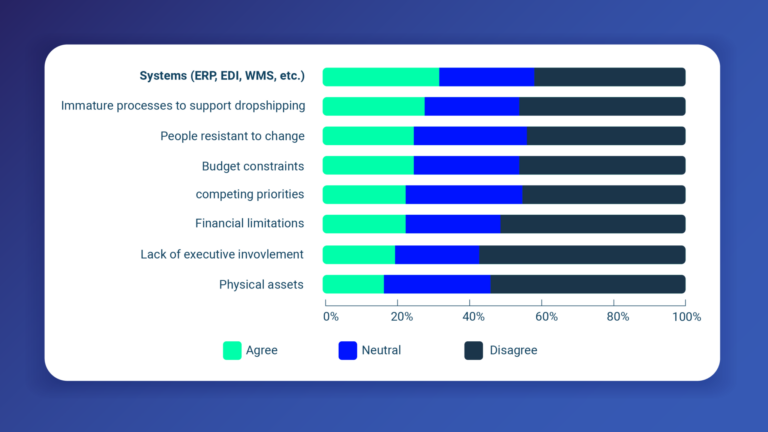

Figure 5: Challenges preventing retailers from implementing dropshipping

Source: Whitepaper – “Supply Chain Collaboration in Transformative Vertical Industries: Implications of Omnichannel and Dropshipping,” DiCentral in collaboration with Center for Supply Chain Research at Lehigh University

The technology infrastructure behind dropshipping is critical to ensuring a streamlined user experience to the business users and a seamless shipping experience to the consumers.

Electronic data interchange (EDI) is becoming the norm for B2B transactions. For large-scale dropshipping programs, it plays an indispensable role due to complex dropshipping business scenarios. In Infor CloudSuite Fashion, an end-to-end cloud-based ERP solution built for the volatile fashion industry, EDI is facilitated through Infor’s Intelligent Open Network (ION) and Infor Enterprise Collaborator (IEC) technologies.

Onboard marketplaces with prebuilt integrations

Having prebuilt integrations to common marketplaces can deliver quick results with less complexity. ERP solutions such as Fortude’s Fashion Retail-in-a-Box (FRIB) and Fashion Brands-in-a-Box (FBIB) allow retailers and brands to quickly onboard marketplaces with minimal effort.

Around 27% of online retailers have switched to dropshipping as their main order fulfillment method.

– e-DSS.org

Conclusion

Together with big data and analytics, dropshipping will shape the future of fashion retail. It will play a key role in determining the growth of F&L retailers in the new digitally centered world of eCommerce. In the years to come, dropshipping will no longer be a trend but a retail industry norm.

Written in collaboration with Absolutelabs.

- Fashion and luxury

- Dropshipping via marketplaces

- A resilient distribution network

- Onboard existing marketplaces

- Leveraging big data and analytics

- Augmented reality and 3D visualizations

- Sustainability as a selling point

- Integrating dropshipping with your ERP

- Onboard marketplaces with prebuilt integrations

- Conclusion

Related Blogs

Subscribe to our blog to know all the things we do